Sedona City Bed Tax

There is so much misinformation and confusion on Sedona City-Bed-taxes.

Data driven information guides us to understand Arizona regulations and the types of taxes imposed on businesses. State, County and Municipality are the three designated taxing areas. All being regulated.

Who imposes Bed-Tax? The City of Sedona is an incorporated designated area, a municipality. The City imposes these taxes on the businesses in the city designated area, the city limits, the City of Sedona.

The name Sedona is used for both the incorporated and unincorporated Sedona areas. Only those inside the incorporated designated area pay city-bed and city-sales tax.

Yavapai County & Coconino County have no Tourism Authority under ARS 5-802. Formation of Authority and don’t qualify to have one under the current laws. https://www.azleg.gov/ars/5/00802.htm

If you’d like to follow the research tracker on this please visit https://donnajoys.com/az-sports-tourism-authority-program-tracker/

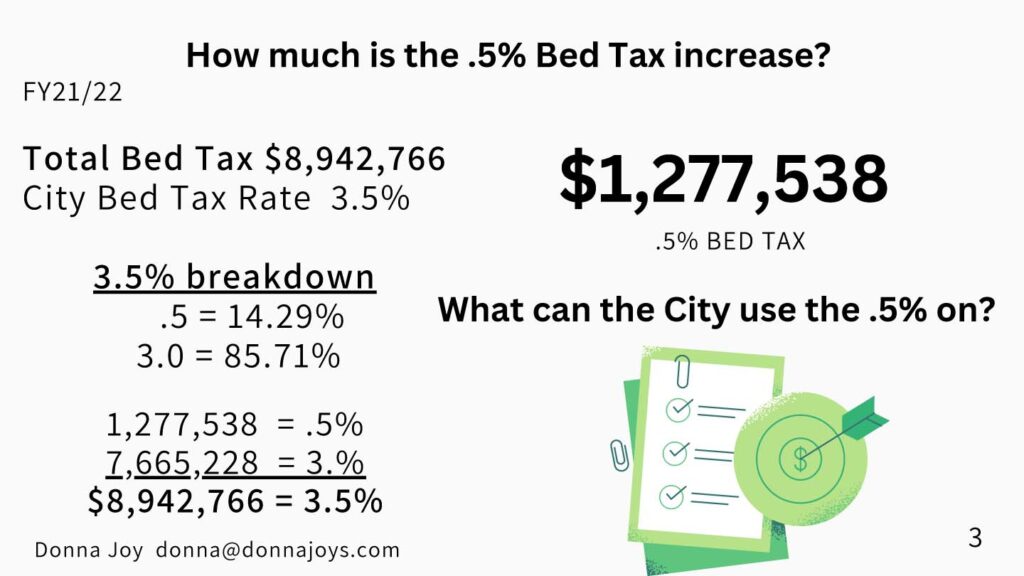

This makes the only Tourism Taxes imposed on the Sedona Area coming from city-lodging businesses footprinted inside the municipality via city-bed-tax. Vacation rentals -STR s inside the city-limits DO collect 3.5% city-bed-tax. State Laws regulate these taxes, only .5% of the city-bed-tax is restricted according to 9-500.06. Hospitality industry; discrimination prohibited; use of tax proceeds; exemption; definitions My website has more details here

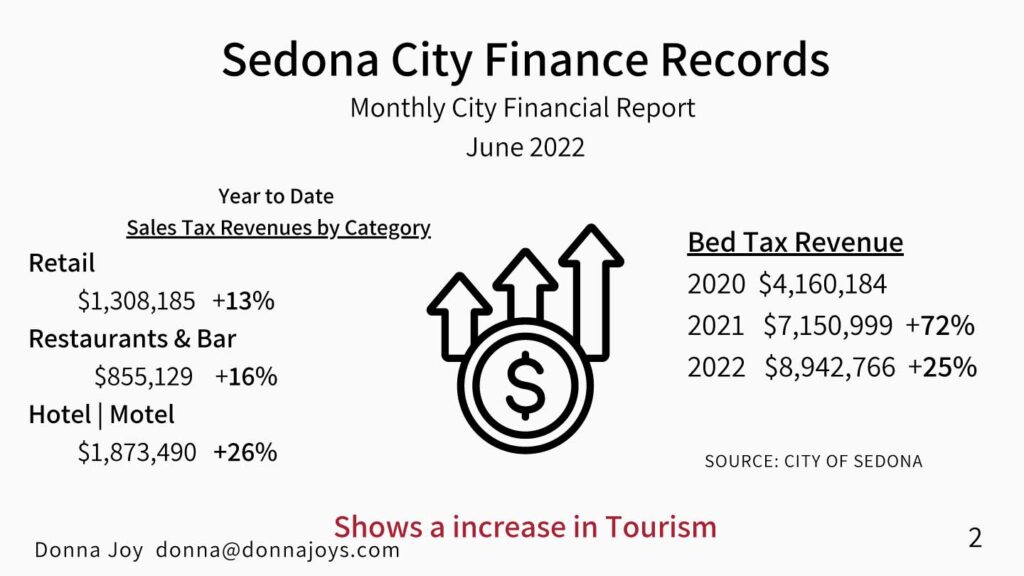

The numbers reported by city only include city-taxes. Status report for Sedona tourism and hospitality source is the City of Sedona.

This article will address:

- How is the Sedona Tourism & Hospitality industry doing?

- The City’s restrictive bed tax is only .5%.

- How much is the .5% bed tax amount and how can it be used?

How is Sedona Tourism and Hospitality industry growing?

According to the City Financial Reports Sedona is growing. In 2021 Bed Tax Revenue jumped 72%. In 2022 it jumped another 25%. This year appears to be running at 26%.

All lodging inside the city limits including vacation rentals pay city-bed tax at 3.5%, a combined city-sales tax & city-bed Tax of 7%.

How much is the .5% bed tax amount and how can it be used?

In 2014 when the city bed tax was raised .5% that action triggered 9-500.06. Hospitality industry; making .5% of the city-bed-tax restricted.

Based off of FY 21/22 the restricted amount of $1,277,538 would be required to use for tourism. However the restricted amount may be used for tourism management, planning, tourism related improvements and marketing.

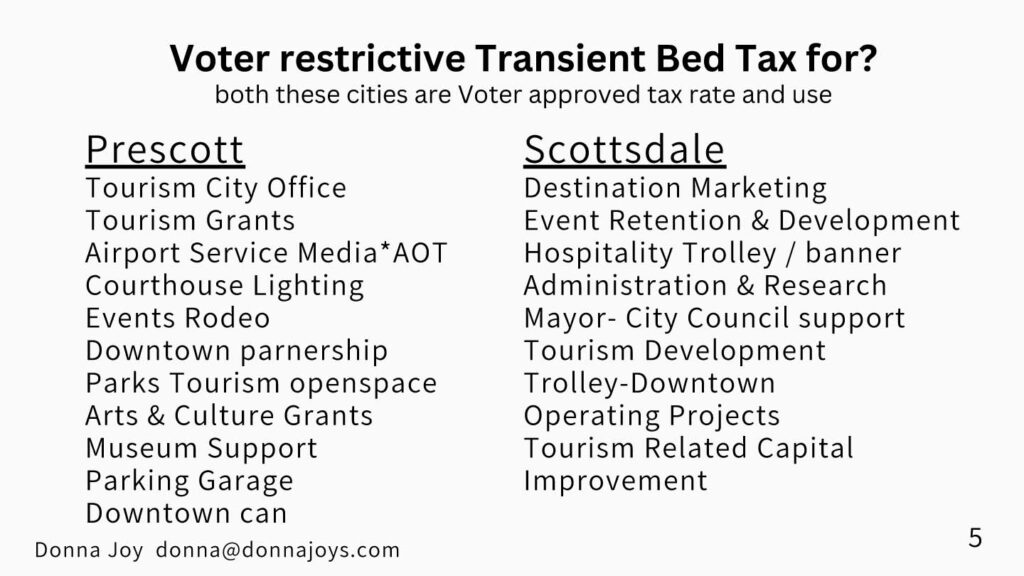

Does the City of Sedona already use this with the services, management, planning ect they provide for tourism? You bet they do! According to budget reports, this is how Scottsdale and Prescott use Transient Bed Tax in Arizona for Tourism.

Sources: City of Sedona, Arizona Office of Tourism AOT, Arizona Revised Statutes, City of Scottsdale, City of Prescott

About the Author

Donna Joy is a lifetime entrepreneur, started in the Biotech, medical field. She was part of a team that developed life saving biological products for implantation in Switzerland and built the company from the ground level. She move back to the US and worked on another startup, Ambulatory Infusion devices medical devices. Medical devices is regulated and products are produced in a cleanroom environment. She moved to Sedona wanting to grow her family. Sedona, a resort town lead Donna and her Husband, Dana into the food business. The food business lead Donna into the Culinary Arts. People Magazine selected and featured Donna Joy as Arizona’s Best Wedding Cake Artist. Her work has been awarded by ESPN Best Grooms Cake, along with other awards. Donna edible art has been featured in movies and magazines. Donna developed a proprietary food line Donna Joy’s® for classic, vegan, dairy free and gluten free.

In 2021 Donna retired from the food industry.

Donna has served on 4 non-profit business boards and is currently serving on a 501C (3) nonprofit charity. Donna loves answers, fact checking and researching much, learning, stats, data crunching, and helping others.

Please visit DonnaJoys.com to see her research projects. You also find some recipes and images of her culinary art there.

Copyright © All rights reserved by Contributor

Disclaimer: Just Facts EDU assumes no responsibility or liability for any errors or omissions in the content of the above article. The information contained in this article was provided by the author “as is” basis with no guarantees of completeness, accuracy, usefulness or timeliness.

Just Facts EDU

Building Communities

Education | Research | Analysis

JustFacts.net

SedonaNewsReport.com

support our work with a tax exempt donation

Just Facts EDU

Tax Exempt 501 C (3)